Option Pricing

Advertisement

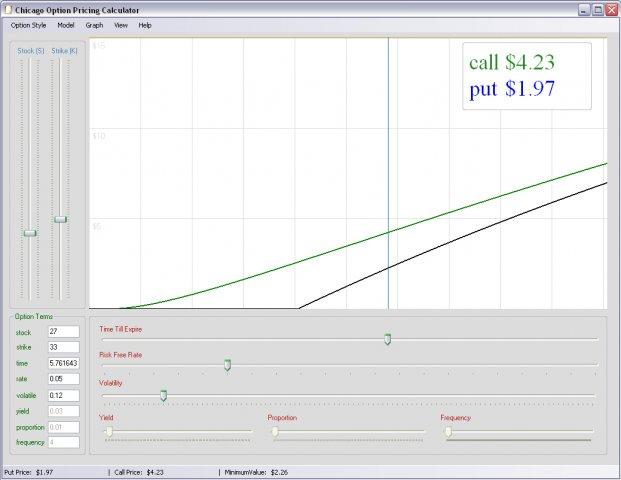

Chicago Option Pricing Model v.1.0

A graphing calculator implementation of the Black-Scholes Option Pricing Model, with extensions for both American Style Options and Extreme Value Theory.

Advertisement

Option Trading Workbook

Option pricing spreadsheet that calculates the theoretical price and all of the Option Greeks for European Call and Put options. The spreadsheet also allows the user to enter up to 10 option legs for option strategy combination pricing. The calculations

Real Option Valuation

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios. Traditional discounted cash flow investment analysis will only accept an

Option Calculator v.2.1.0.0

Application allows user to determine payout characteristics of any arbitrary option spread and is based on Black-Scholes theoretical option pricing model.

Option Calculator P v.2.0.0.0

Application allows user to determine payout characteristics of any arbitrary option spread and is based on Black-Scholes theoretical option pricing model.

OptionEdge v.2 1

OptionEdge is a stock option trading application for use with Microsoft Excel. The program utilizes the Black-Scholes option pricing model to simulate and analyze various stock option trading strategies.

FinOptions XL v.3.0.2

Excel Financial Analytics Add-in valuing option price, risk sensitivities and implied volatility on a broad range of financial instruments including options, futures, exotic, bond options and interest rate assets directly within your spreadsheet.

Visual Stock Options

Visual Stock Options Analyzer is a powerful analysis tool for development, testing, and application of stock and options strategies. Its easy-to-use interface allows you to test new strategies, manage a growing portfolio, and explore "what-if" scenarios

Finatica v.1.0

With Finatica, you can take your strategies to a whole new level. Finatica allows traders to easily research market trends, develop, backtest and deploy strategies, and make forecasts. Finally,

Calc 12c Platinum v.1.3.0.0

The Calc 12c Platinum financial calculator is a software replica of the original HP 12c Platinum.

Prime Option

Prime Option is used to measure what is important and to select the best option. It can be used to choose products, software, development options, shares, funds, staff, features and design points. It can also be used to measure judgments,